42 consider a zero coupon bond with 20 years to maturity

› ~maj › InvestmentsProblem Set #11 Solutions 1. Consider two bonds, A and B ... Consider two bonds, A and B. Both bonds presently are selling at their par value of $1,000. Each pays interest of $120 annually. Bond A will mature in 5 years, while bond B will mature in 6 years. If the yields to maturity on the two bonds change from 12% to 14%, _____. A. both bonds will increase in value but bond A will increase more than bond B Principles of Investments- Chapter 10 Flashcards - Quizlet A zero-coupon bond has a yield to maturity of 5% and a par value of $1,000. ... a. $458.11. Consider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity Yield to Maturity A 1 6.00% B 2 7.50% C 3 8.00% D 4 8.50% E 5 10.25% The expected 1-year interest rate in the third year should be _____. ... Consider the expectations ...

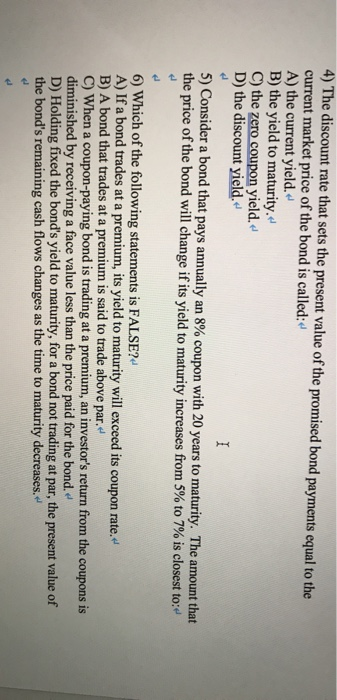

Solved Consider a zero coupon bond with 20 years to maturity | Chegg.com 1) The current yield is: 2). The yield to maturity is: Please show work. Question: Consider a zero coupon bond with 20 years to maturity and $25,000 face value if the current market price is $15,000. (Use semiannual compounding in your calculations). 1) The current yield is: 2). The yield to maturity is: Please show work.

Consider a zero coupon bond with 20 years to maturity

6.2.2 Flashcards | Quizlet C) The yield to maturity for a zero-coupon bond is the return you will earn as an investor from holding the bond to maturity and receiving the promised face value payment. D) When prices are quoted in the bond market, they are conventionally quoted in increments of $1,000. D Consider a zero-coupon bond with $100 face value and 15 years to maturity. corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Example of a Zero-Coupon Bonds Example 1: Annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? 5 = $783.53. The price that John will pay for the bond today is $783.53. Example 2 ... Bond Yield to Maturity Calculator for Comparing Bonds A bond that matures in 20 years is less predictable, and therefore considered a greater risk, so will come with a higher interest rate. In addition to these basic terms, it will also be useful to have a working understanding of the bond rating system. This applies to bonds issued by corporations and other for profit organizations, and the ratings are based on the company's perceived credit ...

Consider a zero coupon bond with 20 years to maturity. Answered: Consider a bond with a zero percent… | bartleby Question 1. Consider a bond with a zero percent coupon rate with 20 years to maturity and a face value of $1,000. What is the price of the bond if the yield-to-maturity is 6%?: $215 $306 $312 $335 Expert Solution Want to see the full answer? Check out a sample Q&A here See Solution Want to see the full answer? Check out a sample Q&A here Solved Consider a zero coupon bond with 20 years to - Chegg See the answer Consider a zero coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is closest to: Expert Answer 100% (1 rating) Price of a Zero coupon bond = Face value * ( 1 + r)-n Fa … View the full answer Previous question Next question Yield to maturity - Wikipedia Consider a 30-year zero-coupon bond with a face value of $100. ... With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of the bond is just 7%, and the yield-to-maturity bargained for when the bond was purchased was only 10%, the annualized return earned over the first 10 years is … › what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years.

Financial Management Exam 3 Flashcards | Quizlet Consider a zero coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is. $311.80. Consider a zero-coupon bond with a $1000 face value and 10 years left until maturity. If the YTM of this bond is 10.4%, then the price of this bond is. 371.80. Advantages and Risks of Zero Coupon Treasury Bonds 31.01.2022 · Thus, the most responsive bond has a long time to maturity (usually 20 to 30 years) and makes no interest payments. Therefore, long-dated zero-coupon bonds respond the most to interest rate changes. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be. BUS307 Ch6 Participation and HW Flashcards | Quizlet 25 -year zero-coupon bonds. If the yield to maturity on the bonds will be 7% (annual compounded ... Consider a zero-coupon bond with a $5,000 face value and 20 years left until maturity. If the bond is currently trading for $2,130 , then the yield to maturity on this bond is closest to:

› terms › sStrip Bonds Definition - Investopedia Aug 17, 2020 · Strip Bond: A strip bond is a bond where both the principal and regular coupon payments--which have been removed--are sold separately. Also known as a "zero-coupon bond." Solved Consider a zero-coupon bond with 20 years to | Chegg.com This problem has been solved! See the answer Consider a zero-coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from 7% to 5% is closest to: Expert Answer 100% (1 rating) Previous question Next question Chapter 6 - Corporate Finance bond. • Calculate the yield to maturity for both coupon and zero- ... 20. Coupon Bonds (1 of 2). • Coupon Bonds. – Pay face value at maturity.119 pages VALUATION (BONDS AND STOCK) - University of South Florida bonds traded in the financial markets perhaps were originally issued 10 to 20 years ago when interest rates were different than today. • Foreign Debt Instruments o Foreign debt—debt sold by foreign issuers o Eurodebt—debt sold in a country other than the one in the currency in which it is denominated • Valuation of Bonds—the coupon rate specifies the amount of interest that is …

Chapter 06 - used t read it - Corporate Finance, 3e (Berk ...

What Is the Coupon Rate of a Bond? - The Balance 18.11.2021 · Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years.

Answered: Consider a zero-coupon bond with a… | bartleby We've got the study and writing resources you need for your assignments.Start exploring!

Consider a zero coupon bond with 20 years to maturity Consider a zero coupon bond with 20 years to maturity The percentage change in from FINANCE 341 at Illinois State University

Solved Consider a zero-coupon bond with 20 years to - Chegg Finance. Finance questions and answers. Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is closest to: Select one: O A. $306. OB. $312 O c. $335. O D. $215. Question: Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is ...

Post a Comment for "42 consider a zero coupon bond with 20 years to maturity"