40 coupon rate and market rate

Vacancy rates up in Winnipeg and across Manitoba: survey - Winnipeg ... While higher vacancy rates are welcome news for once-beleaguered renters, the bad news is that they're also paying an average of 4.8 per cent more — $969 versus $911 — for a two-bedroom ... Currency Converter Winnipeg Downtown | Currency Mart Convert. About Currency Converter. About Exchange Rate. Location. Currency Exchange Winnipeg Downtwn Currency Mart. 240 Graham Ave. Suite 290 Winnipeg, MB R3C 0J7. (204) 800-8122. Branch Profile. Deals.

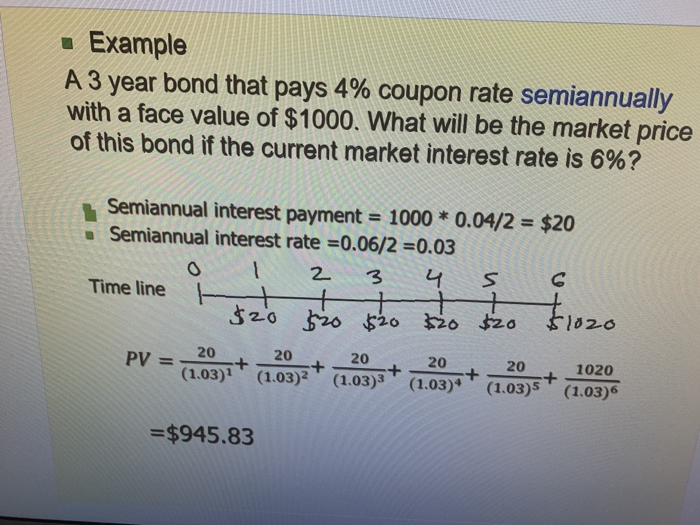

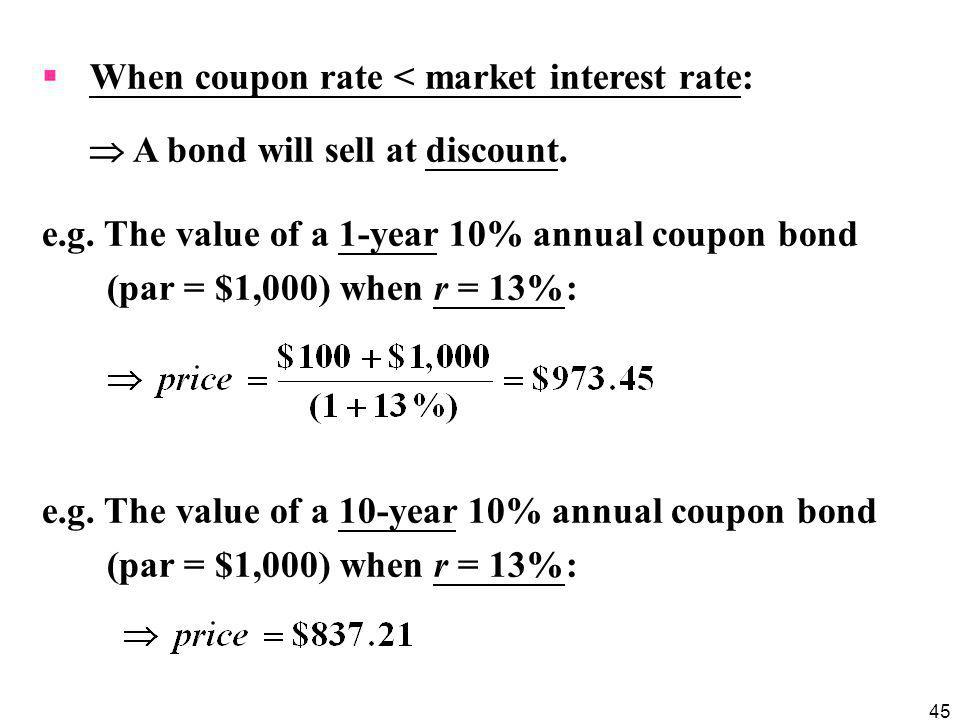

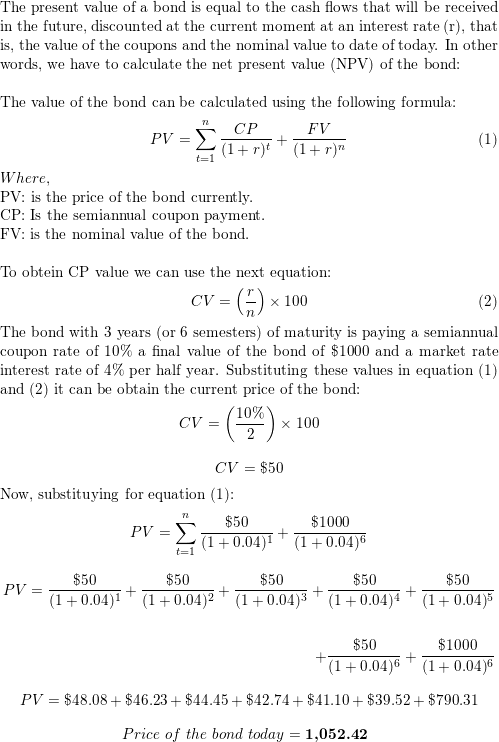

Bond Stated Interest Rate Vs. Market Rate | Pocketsense A coupon rate can best be described as the sum, or yield, paid on the face value of the bond annual over its lifetime. So, for example, if you had a 10-year bond with a value of $1,000 and a coupon rate of 10 percent, the purchaser of the bond would receive $100 each year in interest. This differs from the market interest rate of a bond, which is a fluctuating value that generally reflects market sentiment.

Coupon rate and market rate

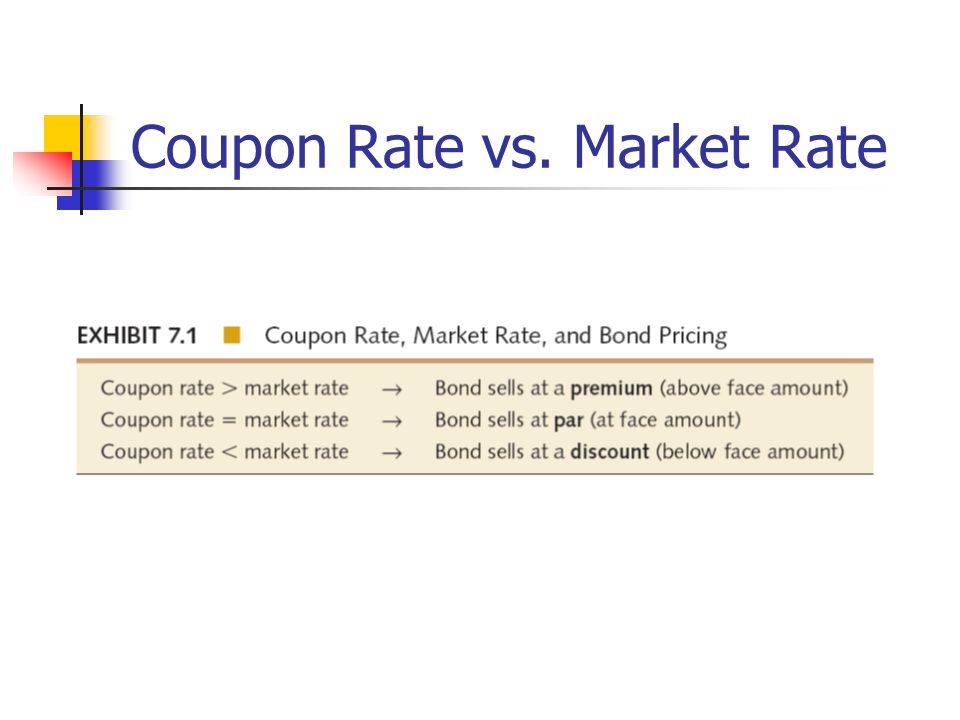

Finance exam 2 Flashcards | Quizlet YTM is the prevailing market interest rate for bonds with similar features. It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. Bonds - Coupon and Market Rates Differ - YouTube Lesson discussing how the value of a bond changes when coupon rates and market rates differ. Looks at why a bond will trade at a premium, discount, or at pa... Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

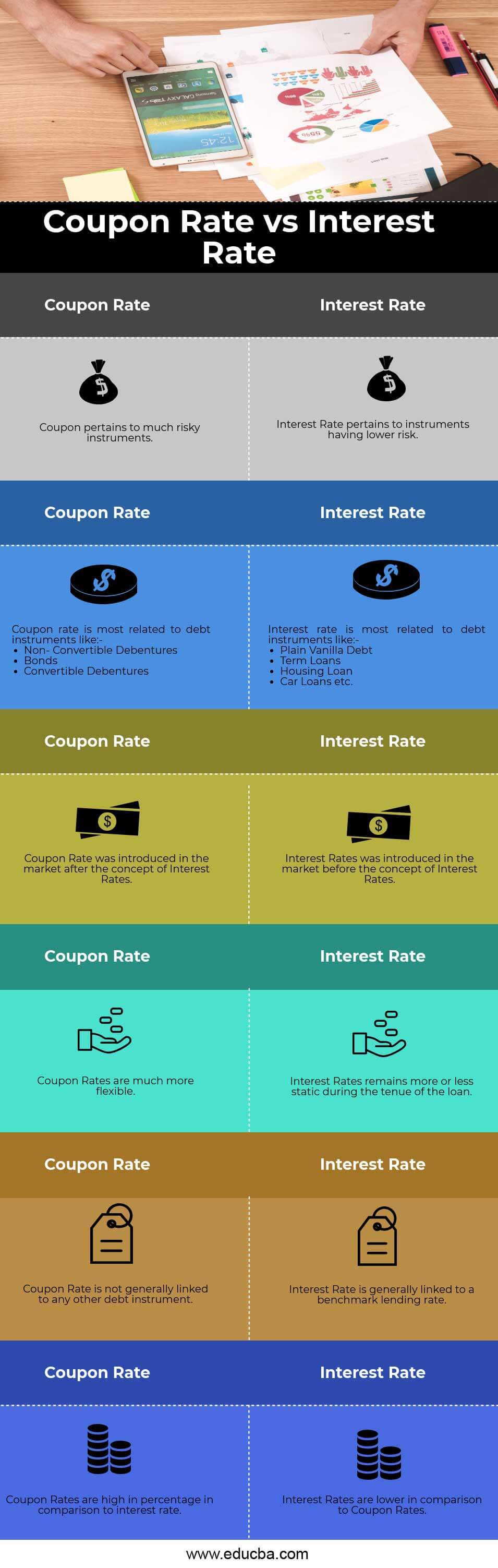

Coupon rate and market rate. Province of Manitoba | v1 - rates Rates are based on the cost to provide the utility service. The PUB determines the public interest in our decisions and recommendations; this is done by balancing the interests of ratepayers with the financial stability of the utility. Rates set by the Board must reflect prudent expenditures and must be just and reasonable for the ratepayer ... What is the difference between coupon rate and market - Course Hero Since a bond's coupon rate is fixed all through the maturity, a bond holder is stuck with receiving comparably lower interest payments when the market rate is offering a higher interest. If a bond sells at its par value or face , you will get your principle back plus the periodic interest at its maturity . Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA Coupon Rate was introduced in the market after the concept of Interest Rates: Interest Rates was introduced in the market before the concept of Interest Rates: Coupon Rates are much more flexible: Interest Rates remains more or less static during the tenure of the loan: The coupon Rate is not generally linked to any other debt instrument Understanding Coupon Rate and Yield to Maturity of Bonds When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Now, what if you bought the security in the secondary market?

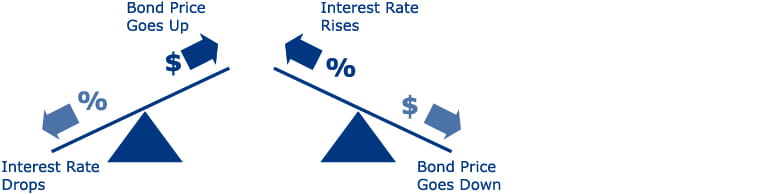

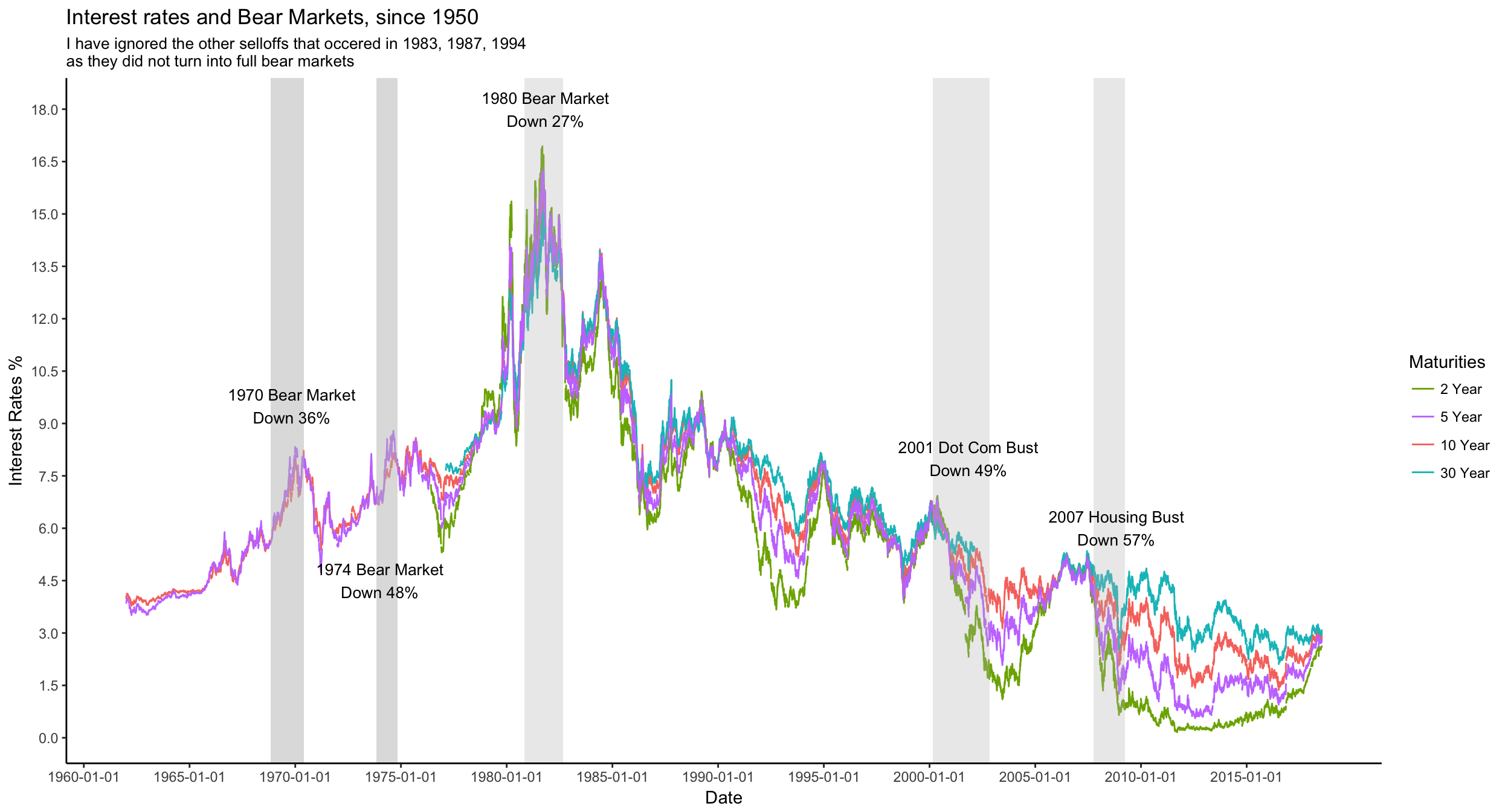

Coupon Rate Calculator | Bond Coupon The relationship between coupon rates and market interest rates For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and it is manipulated by the government depending totally on the market conditions A Bond's Price given a Market Discount Rate - AnalystPrep If the bond has a coupon rate of 7% and the market discount is 6%, its price would be 104.21, and it would be trading at a premium. P V bond = 7 1.061 + 7 1.062 + 7 1.063 + 7 1.064 + 107 1.065 = 104.21 P V b o n d = 7 1.06 1 + 7 1.06 2 + 7 1.06 3 + 7 1.06 4 + 107 1.06 5 = 104.21. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing When the prevailing market interest rate is higher than the coupon rate of the bond, the price of the bond is likely to fall because investors would be reluctant to purchase the bond at face value now, when they could get a better rate of return elsewhere. Conversely, if prevailing interest rates fall below the coupon rate the bond is paying, then the bond increases in value (and price) because it is paying a higher return on investment than an investor could make by purchasing the same type ...

Bond Coupon Interest Rate: How It Affects Price - Investopedia The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if... Manitoba urged to boost welfare rates - Winnipeg Free Press The poverty rate is $1,537 a month, according to the Market Basket Measure, a measure of low income based on the cost of a specific basket of goods and services including shelter and ... Coupon Rate Definition - Investopedia A bond issuer decides on the coupon rate based on prevalent market interest rates, among others, at the time of the issuance. Market interest rates change over time and as they move lower or higher... The Difference between a Coupon and Market Rate - BrainMass In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary This solution explains the difference between a coupon rate and market rate. $2.49

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

Bonds - Coupon and Market Rates Differ - YouTube Lesson discussing how the value of a bond changes when coupon rates and market rates differ. Looks at why a bond will trade at a premium, discount, or at pa...

Finance exam 2 Flashcards | Quizlet YTM is the prevailing market interest rate for bonds with similar features. It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity.

:max_bytes(150000):strip_icc()/interest_rate_istock496445100-5bfc47a6c9e77c002636cbdc.jpg)

Post a Comment for "40 coupon rate and market rate"